June update from our CEO, Sacha

[et_pb_section fb_built=”1″ _builder_version=”4.4.8″][et_pb_row _builder_version=”4.4.8″][et_pb_column type=”4_4″ _builder_version=”4.4.8″][et_pb_text _builder_version=”4.4.8″]

It’s six months since we shared our last detailed update in January, and the world feels like a very different place now. In that time, we moved into our new offices in Commercial Street – and just as we were getting settled Covid-19 hit and we quickly adjusted to working remotely whilst also growing our team. We’ve rapidly pivoted our strategy to reflect the new world we are in. We’ve built our team and extended our board to bring broader insights and perspectives to govern our work. It has been intense – and this update is suitably long to reflect that!

Click on the section headings below for an update on each topic.

[/et_pb_text][et_pb_accordion _builder_version=”4.4.8″ hover_enabled=”0″][et_pb_accordion_item title=”A reminder of who we are and our approach ” open=”on” _builder_version=”4.4.8″]

Fair4All Finance was founded to support the financial wellbeing of the most vulnerable groups in society by increasing access to fair, affordable and appropriate financial products and services. Through increasing access to and the use of fair financial products and services, we will help people in vulnerable circumstances to meet their day to day financial needs, absorb shocks and smooth incomes.

Our vision is of a society where the long-term financial wellbeing of all people is supported by a fair and accessible financial sector.

Our mission is to increase the financial resilience of people in vulnerable circumstances by providing access to fair, affordable and appropriate financial products and services.

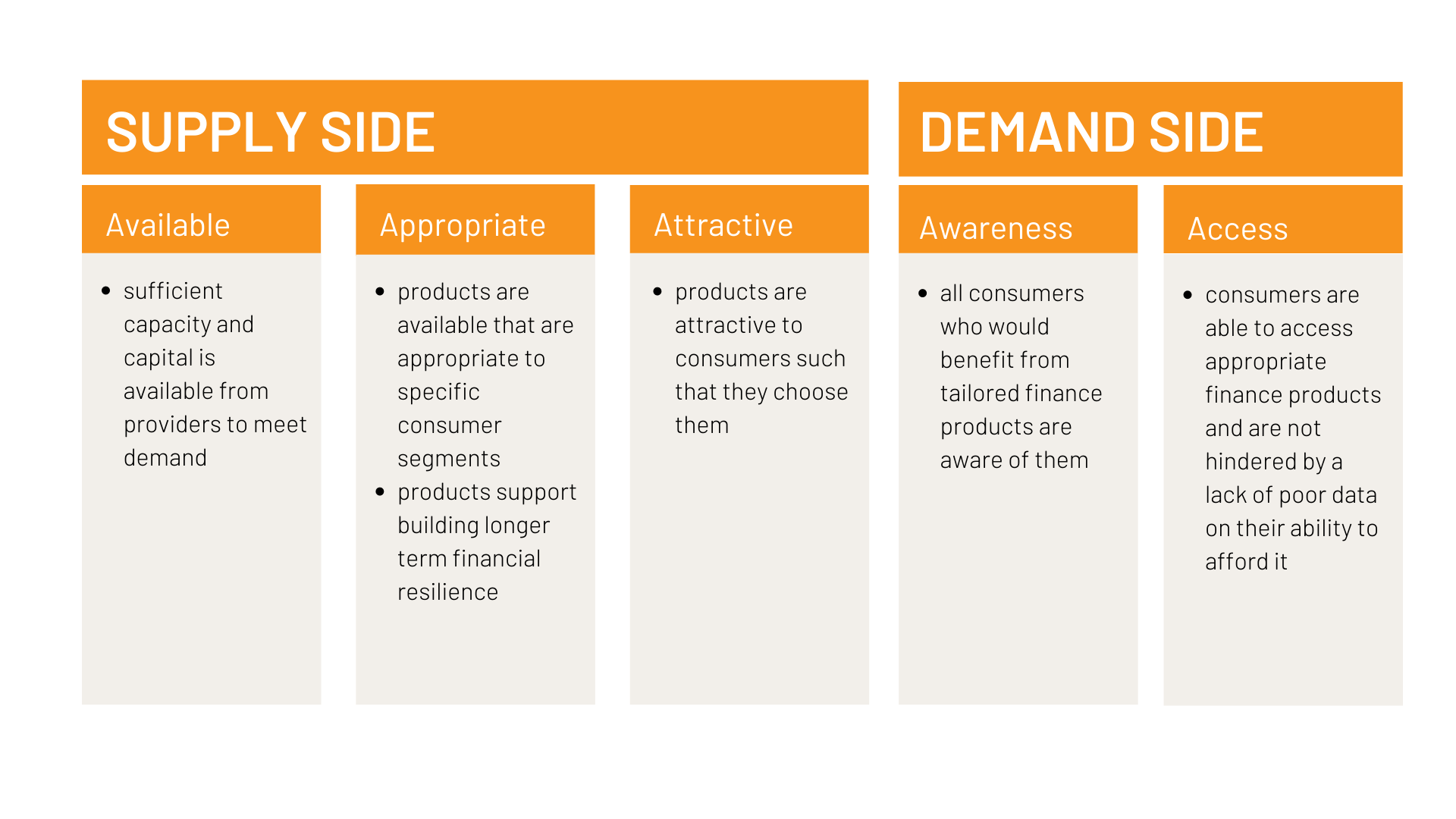

Our strategic drivers look at supply and demand across the whole financial services system:

We will deliver this work through five workstreams:

- Systems change and impact: deliver, influence and evidence impact of systemic change to society

- Funding, finance & investment: enable affordable long-term financing for providers

- Operational excellence and capability: optimise sustainable operating models for providers

- Governance, leadership and talent: create a strong pipeline of talent and transformational leaders

- Markets, consumer insights and product design: enable well-designed solutions that build wellbeing to reach the people and communities we wish to serve

Our initial focus has been on affordable credit – where we set a challenge to scale the market by 10x to meet current demand.

[/et_pb_accordion_item][et_pb_accordion_item title=”The 10x challenge – scaling affordable credit provision ” _builder_version=”4.4.8″ hover_enabled=”0″ open=”off”]

- Our report Transforming Affordable Credit in the UK was published in February. It sets out our Theory of Change, developed with input from multiple stakeholders, and initial findings from our pilot programme on what it will take to scale up responsible finance providers to meet the demand for affordable short-term credit in the UK.

- The next phase of our Affordable Credit Scale-up Programme is now open for applications. The programme is designed to provide tailored support to sustainably scale affordable credit, as part of the wider transformation of financial services to better meet the needs of people in vulnerable circumstances. It builds on our pilot programme with five organisations – Enterprise Credit Union, Fair for You, Five Lamps, Leeds Credit Union and Moneyline – which has been running since July 2019. More details, including case studies of support given to our pilot partners are available here.

Work is progressing in each of the five opportunity areas identified from our work to date:

Systems change and impact

- Hanadi Al-Saidi is working with Fair For You and Damon Gibbons at the Centre for Responsible Credit on the development of an impact reporting approach and framework to evidence the economic value of the societal impact created through provision of affordable finance

- Tom Lake and Fionn Sharpe are leading our work with government and regulators to influence and inform policy based on the evidence we gain from our work

- Sacha Romanovitch is chairing the Money and Pensions Service Challenge Group on Affordable Credit, ably supported by Tom and Fionn

Finance, funding and investment

- Holly Piper is finalising our plans for raising an Affordable Credit Debt Fund to facilitate the injection of lending capital into affordable credit providers

Markets, consumer insights and product design

- Sarah Williams-Gardener and Hanadi Al-Saidi are developing our detailed consumer insights to enable providers to access data to inform marketing and product design. We are delighted that Moneyline, Fair By Design and Citizens Advice are working closely with us as we develop this workstream, along with representatives from our board

- Jonathan Turner has been leading on the next phase of our work to gain evidence on whether additional data could allow providers to make better credit decisions. Edinburgh University is currently scoping the research to support a commission of the full piece of work later this year

Operational excellence

- Jonathan Turner and Sarah Williams-Gardener, with voluntary support from Will Bicknell who is on furlough from Oakbrook Finance, are developing the approach to how technology is best developed to enable efficient and attractive customer journeys and back-office delivery. We plan to share early output from this in the next few months

Governance, leadership and talent

- Sacha, Becky Claydon and Samantha O’Byrne are in the early stages of designing our work in this area; it will include best practice governance guides for scale-up organisations, leadership development programmes and a Talent Bank to provide a source of people with great skills and experience for both executive and non-executive roles to build bench strength of teams

[/et_pb_accordion_item][et_pb_accordion_item title=”Responding to Covid-19″ _builder_version=”4.4.8″ open=”off”]£3.1m distributed to affordable credit providers helping to preserve 40% of market capacity

The Covid-19 pandemic has presented huge financial problems for millions of people across the country. During this crisis, and in its aftermath, it is more important than ever that people have access to fair and affordable financial products and services that support their financial wellbeing. At the same time, reduced demand for lending, additional forbearance costs and operational costs associated with transitioning to remote services are causing significant challenges for the sustainability of vital affordable credit providers. To guide how we pivoted our 2020 strategy to respond to the crisis we set three outcomes:

- Affordable credit sector intact and potentially stronger through an acceleration of changes

- Individuals emerge without a debt mountain or harm to their longer-term financial wellbeing

- Accelerate change in the wider financial services system so that people in vulnerable circumstances are served better overall

With input from providers, consumer groups, charities, foundations and trade bodies, we launched our £5m Covid-19 Resilience Fund on 8 April, to allow lenders to provide customers appropriate forbearance and ensure that the affordable credit sector can emerge from the crisis in a resilient position and capable of future growth.

To date we have committed c£3.1m in grants to 23 responsible lenders. These organisations collectively lent around £100m in the last year and serve 122,000 customers, meaning that this intervention helps to preserve around 40% of capacity targeted at people in vulnerable circumstances in the affordable credit sector. You can find more information on the Fund here.

To shape our ongoing policy response to the Coronavirus pandemic, we completed research using secondary sources to map the groups most financially impacted by the economic fallout of the crisis. Research suggests that more than 6.5 million jobs could be temporarily lost in the UK, with low earners, women, and young people among the most severely impacted. You can read the report here.

[/et_pb_accordion_item][et_pb_accordion_item title=”How we make Black Lives Matter ” _builder_version=”4.4.8″ open=”off”]We have been deeply saddened and angered by the deaths of George Floyd, Breonna Taylor, Ahmaud Arbery, Belly Mujinga, and other victims of racist violence across the world. We have also been extremely troubled by the disproportionate impact that the Covid-19 crisis is having on people from Black, Asian and minority ethnic backgrounds in the UK. These events have been shocking, but we know that the underlying causes are not new.

We have been in engaging in internal discussions to identify and execute our role in dismantling structural racism and are committed to doing more to increase the financial inclusion of Black, Asian and minority ethnic communities. If you want to learn more about this, our latest Research Round-Up provides a summary of some of the existing evidence on racial economic inequality in the UK.

[/et_pb_accordion_item][et_pb_accordion_item title=”New funding ” _builder_version=”4.4.8″ open=”off”]Last month it was announced the balance of the £55m already allocated to us and a new £41m allocation would be made available to us from Dormant Assets. This funding has enabled our Covid-19 resilience fund and the rapid expansion of our Affordable Credit Scale-up Programme.

It will also be used to urgently develop other initiatives for the emerging needs of customers for whom affordable credit is not an appropriate solution. We appreciate this additional distribution of funds and will ensure that it supports the development of sustainable solutions for people in vulnerable circumstances.

[/et_pb_accordion_item][et_pb_accordion_item title=”Evolving our strategy ” _builder_version=”4.4.8″ open=”off”]With the fallout from Covid-19, the painful reminders of structural inequalities and the far-reaching impacts of the climate crisis, it is timely for us to refresh our strategy to ensure it remains relevant on what will make the most difference now and for sustainable systems change. Wayne Gretzky, the famed Canadian ice hockey player said of his success: ‘I skate to where the puck is going, not where it has been’. Amidst so many uncertainties as to what the future holds, including the economic outlook, how people will respond to the situation and how providers will adapt, we need to set a way to navigate and pivot.

We are developing scenarios – different pictures of how the world might be to inform our strategic choices and what data we’ll monitor to give us foresight in the choices we make. The pockets of the future are all around us if we set ourselves up to see them! Our involvement in chairing the Workplace and Credit Counts: Affordable Credit challenge groups as part of the development of the National Financial Wellbeing Strategy provides another useful input into both outlook and priorities.

We will be developing our work over the summer and welcome input as we move forward.

[/et_pb_accordion_item][et_pb_accordion_item title=”Growing our team ” _builder_version=”4.4.8″ open=”off”]

Our plan is to keep our team lean and yet we have been running very tight since our formation. I am delighted that we have attracted some high calibre new people to the team, and we are also seeking some key roles to enable us to deliver our plans well.

- We were pleased to be joined by Holly Piper, our new Investment Director. Holly will lead on our Finance, Funding and Investment workstream which is focused on supporting providers serving people in vulnerable circumstances to scale and grow sustainably. She was previously Head of CAF Venturesome where she led the team making hundreds of affordable social investments to a wide range of social organisations – from local community-led housing groups to major international development charities.

- We also welcomed Sarah Williams-Gardener, who joins the team as a consultant, leading our Markets, Consumer Insights and Product Design workstream. Sarah was a founding member of Starling Bank where she first developed an interest in financial inclusion, leading on initiatives including the creation of the “Gambling Block” for consumers who wanted to customise and control their spending.

- We appointed four new board members: Ria Bailes, Fozia Irfan, Jennifer Rademaker and Mike Anderson. They bring rich experience from housing, community work, global platform delivery and banking and treasury to complement the skills of our existing board members and extensive networks to support the delivery of our mission. Find out more about our new and existing board members here.

- We have been recruiting for a Programme Manager and a Strategic Communications Manager and expect at least five more roles to go live in the next few months. Keep an eye out for opportunities on our jobs page, and do connect us with those in your network who bring passion, skills and experience to further our work.

[/et_pb_accordion_item][et_pb_accordion_item title=”Communications” _builder_version=”4.4.8″ open=”off”]Along with the recruitment of a full-time communications staff member, we have been investing in our website. We have recently made several changes to help improve the user experience including updating our news section, introducing a new report section and embedding flipbooks to improve the reader experience. Next on the list is a significant expansion in the content relating to our strategy, approach and future-plans beyond Affordable Credit, to reflect what is outlined above. Please do get in touch if you have ideas for how we can further develop our online presence. [/et_pb_accordion_item][et_pb_accordion_item title=”Date for your diary – our AGM will be on 17 September at 12.30 ” _builder_version=”4.4.8″ open=”off”]We’ll be holding this online and using it as an opportunity to share our progress and what’s next with our wide stakeholder group. Help us shape our agenda by letting us know what would make it interesting and relevant for you. Please send your ideas to Temi Odesanya. [/et_pb_accordion_item][/et_pb_accordion][et_pb_text _builder_version=”4.4.8″]

Final words

The intensity of the last months has been quite something and I’d like to thank the team at Fair4All Finance and all our stakeholders for their energy and commitment through this. I’d also like to thank all those who have donated their time to us in this period: Rachel Heydecker and Niall Alexander from Carnegie UK Trust, Adam Jackson, Will Bicknall, and the teams at PwC and Permira who gave us pro bono support. I think we are all blessed to be working in an area where we have had something with such a relevant purpose to be focused on – and even so, I am inspired and hugely appreciative of all the work that has gone in by so many.

Thank you.

Sacha

Sacha Romanovitch, CEO

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]