Update on our Covid-19 Resilience Fund

Update on our Covid-19 Resilience Fund – 40% of affordable credit capacity for people in vulnerable circumstances supported to date

The Covid-19 pandemic presents huge financial problems for millions of people across the country. During this crisis, and in its aftermath, it is more important than ever that people have access to fair and affordable financial products and services that support their financial wellbeing. At the same time, reduced demand for lending, additional forbearance costs and operational costs associated with transitioning to remote services are causing significant challenges for the sustainability of vital affordable credit providers and their ability to continue to serve people in vulnerable circumstances through and beyond the crisis.

Our Covid-19 Resilience Fund, launched last month, is designed to allow lenders to provide customers appropriate forbearance and ensure that the affordable credit sector can emerge from the crisis in a resilient position and capable of future growth.

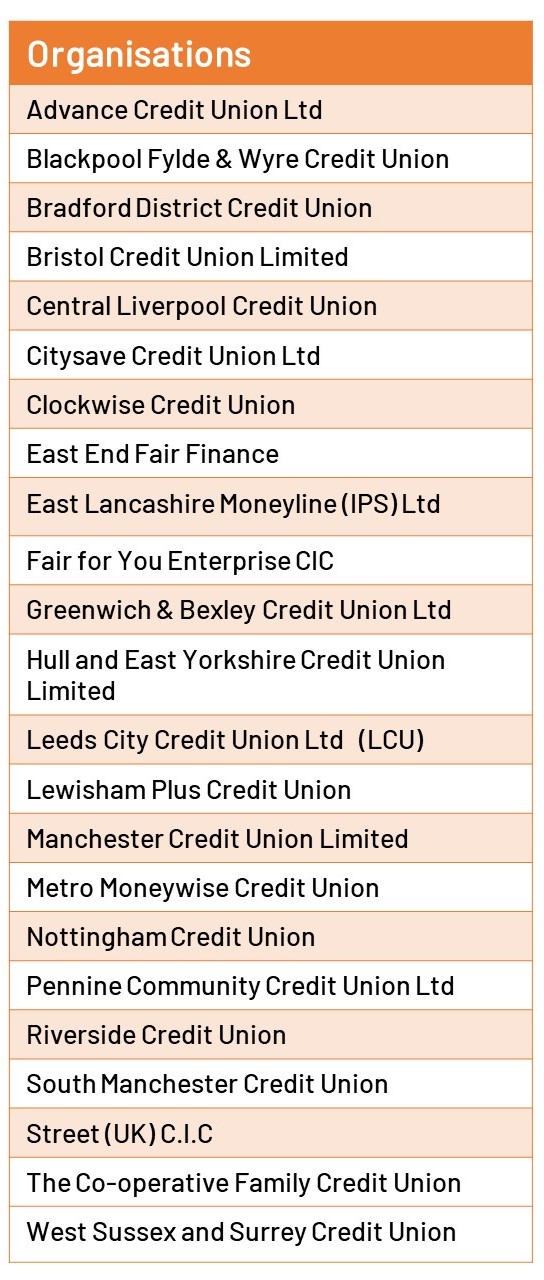

To date we have committed c£3.1m of support to 23 responsible lenders. These organisations collectively lent around £100m in the last year and serve 122,000 customers, meaning that this intervention helps to preserve around 40% of capacity targeted at people in vulnerable circumstances in the affordable credit sector.

This support comprises a mixture of financial support to help organisations manage the impact of lost income and additional forbearance costs caused by the crisis on their organisational strength, and funding for technical support needed to adapt models to serve customers during this period.

Applicants were taken through a rigorous and rapid assessment process, in which they were required to demonstrate a proven track record of delivering social impact for people in vulnerable circumstances in a financially sustainable way and that there was a real need for the funding to enable them to sustain growth plans as we emerge from the crisis.

To allow evaluation of the impact of the programme, participating organisations are committed to reporting to us the impact on the customers in vulnerable circumstances they serve that the support has enabled and the lending capacity that it is has maintained or increased into the sector.

Kashaf Ali, Chief Executive of Street UK Group, commented:

“The grant assistance which Street UK have received from the Fair4All Finance Covid-19 Resilience Fund will be of significant assistance to us in mitigating the impact of Covid-19 on our organisation at this difficult time. It will assist in enabling us to continue our mission of supporting our financially vulnerable customers and support us in growing and developing on our experience of providing technological support and solutions in this sector. We found the application and the assessment process to be thorough, very fair and easy to navigate.”

Teresa Manning MBE, Chief Executive of Clockwise Credit Union, said:

“We’re delighted to have received support from Fair4All Finance which will help us ensure there is less impact of this crisis on our credit union. Fair4All’s help has given us the added resilience to continue to deliver our plan for ambitious growth, and to continue our investments in IT and people, whilst responding to reduced income, all ensuring we can continue to support people in vulnerable circumstances. The process was rapid and largely relied on information we already had to hand, which was refreshing.”

Applications to the Covid-19 Resilience Fund closed on Monday 22 June 2020. Full details on the fund can be found here.

A full list of applicants receiving support from the fund to date is below: