Celebrating International Women’s Day – Emma Goodwin, Deputy CEO of Fair For You

To celebrate International Women’s Day, we’ve been speaking to some of the many inspirational women leaders across the community finance sector. In the third instalment of our series we hear from Emma Goodwin, Deputy CEO at Fair For You about the challenges facing women leaders in the finance sector, why developing and fostering an inclusive environment is so important, and the role that CDFI’s like Fair For You can play in building financial resilience among women.

What motivated you to aspire to a leadership role and empowered you to achieve your career ambitions?

Purpose. I want to look back on my career and be proud: be proud of the work that I have done and the impact that I have had. I have always been passionate about supporting and developing people. Aspiring to a leadership role has enabled me to give back and help support my team in achieving their potential.

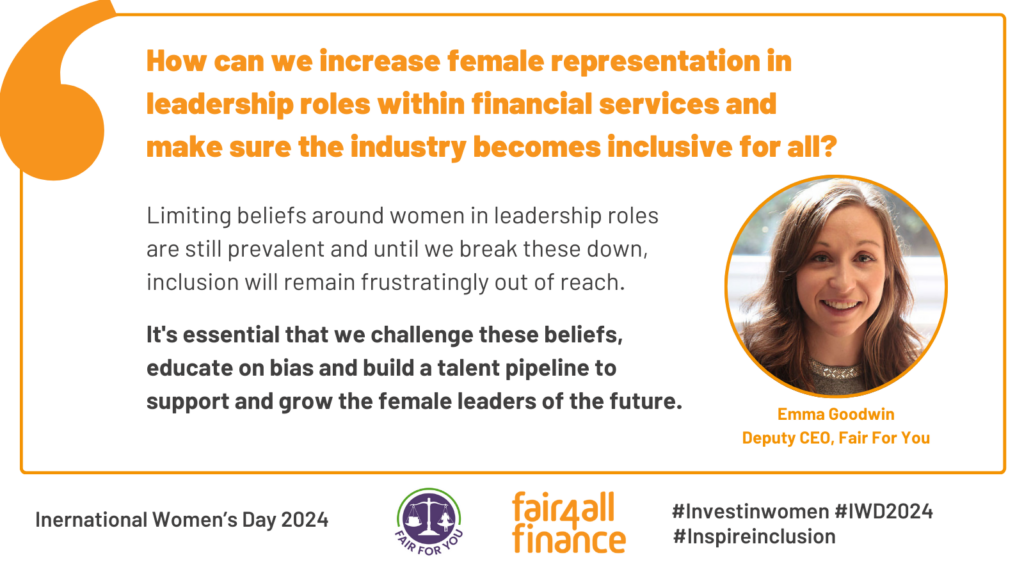

How can we increase the representation of women in leadership roles within financial services and ensure the industry becomes inclusive for all?

Becoming a leader is much more than simply being put into a leadership role; it involves an identity shift from both the individual and by others who work with them to see them as such.

Limiting beliefs around women in leadership roles are still prevalent and until we break these down, inclusion will remain frustratingly out of reach. It’s essential that we challenge these beliefs, educate on bias and build a talent pipeline to support and grow the female leaders of the future.

What does this year’s theme of ‘Inspiring Inclusion’ mean to you?

To celebrate diversity and recognise what can be achieved by including a variety of perspectives, opinions and contributions. I have seen first hand how developing and fostering an inclusive environment brings the best out of people and teams, leading to increased diversity of thought.

What are some of the main barriers that hinder women from accessing mainstream and alternative finance?

The most significant barriers are stereotypical gender and social norms regarding access to education, financial confidence and literacy, ability to work and financial independence.

How can community finance help improve the financial wellbeing and independence of women?

Simply put: access to affordable and ethical credit. As a CDFI whose customer base is predominantly female, we have been able to support thousands of women with the day to day pressures of making ends meet by providing that buffer for when the fridge stops working, the washing machine breaks down or the children are off from school and the food bill sky rockets.

What impact can community finance have on improving the financial lives of women in vulnerable circumstances?

The potential is huge: access to credit could be the difference between someone staying in an abusive relationship or being able to start again; financial stress and difficulty drastically reduces recovery rates for common mental health condition so a credit union or CDFI and their services could be the difference between recovery from mental health conditions or not; it could simplistically enable someone to not have to choose between heating or eating this week.

We know from our latest segmentation research that women are at a greater risk of financial exclusion because of gender specific barriers, which can heighten cost-of-living pressures and weaken financial resilience – you can read more about these barriers to inclusion here.