Talk Money Week 2023 – Let’s talk about debt

It’s Talk Money Week this week – a week designed to break the taboo of talking about money and improve people’s financial wellbeing. We’ve asked the Fair4All Finance team to share their thoughts throughout the week on ‘if you could do one thing…’ to improve financial inclusion.

Today we hear from our Deputy CEO, Kate Pender.

We need to talk about debt

The theme for Talk Money Week this year is Do One Thing – so what one thing can we all do to improve financial inclusion?

The cost of living crisis is biting, and for many people this isn’t a new crisis – it’s simply their lives, and has been for a very long time. They’re reluctantly welcoming people who are struggling in this crisis for the first time to a club where they never wanted to be members. This is not what we mean by financial inclusion!

Whether you’re experiencing this crisis at the supermarket, in your mortgage payments, or on your rent as your landlord passes on their increased costs to you; it’s a rotten situation.

Contrary to lots of stereotypes, many people who are in vulnerable circumstances are superb budgeters and are deftly managing really tight finances. Many of them have done every single thing they can imagine to manage their costs during this crisis. And sadly, what is left for some, is a really uncomfortable share of monthly income going on servicing debt.

For some of these people what’s really needed is the expert support and empathetic help of a debt advisor; and yet many people seek debt advice much too late. For others encouragement to check out their entitlement to benefits which can make a massive difference to monthly income and where a huge portion of people who are eligible are in employment, but don’t know that they have a claim to make (or feel there is a stigma associated with claiming benefits that they are entitled to).

For others, a debt solution like a debt management plan, debt relief order or could really help but might unnecessarily impact their credit file where a consolidation loan would give them a better outcome, especially if offered by a credit union or provider offering equivalent rates.

Affordable consolidation loan: illustrative use case

By consolidating with a credit union, a borrower with £6,500 of debts (the median amount owed by a StepChange debt advice client) at an average 55% APR (based on 40%-69% typical for credit union consolidation customer) could reduce their monthly repayments by hundreds and can even lower the overall cost of credit.

| 55% APR over 24 months | 42.6% APR over 36 months | 24% APR over 36 months | 12.7% APR over 36 months | |

| Monthly repayments | £452 | £323 | £255 | £218 |

| Total repayment | £10,852 | £11,616 | £9,180 | £7,851 |

Even across a longer term, taking a consolidation loan can provide a useful alternative to insolvency solutions which impact people’s credit scores for 6 years.

Where does this fit in the options customers have?

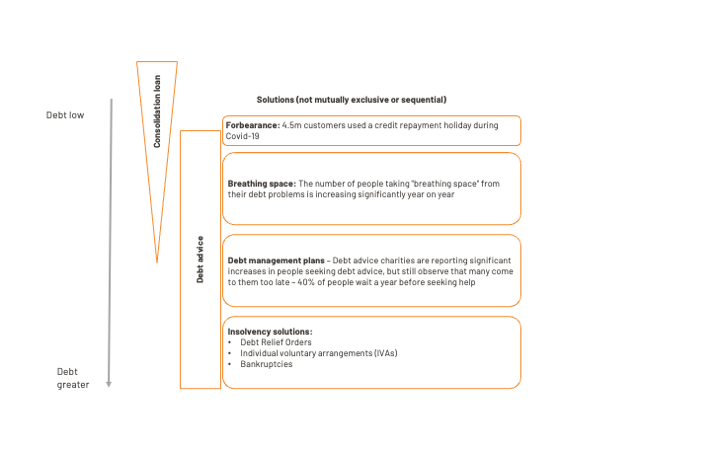

We recognise that a consolidation loan is just one of the solutions available and sits on a spectrum of options. Our rough schematic shows how consolidation lending can support people before other debt solutions are necessary and the vital importance of helping people get good advice earlier.

Who would this help?

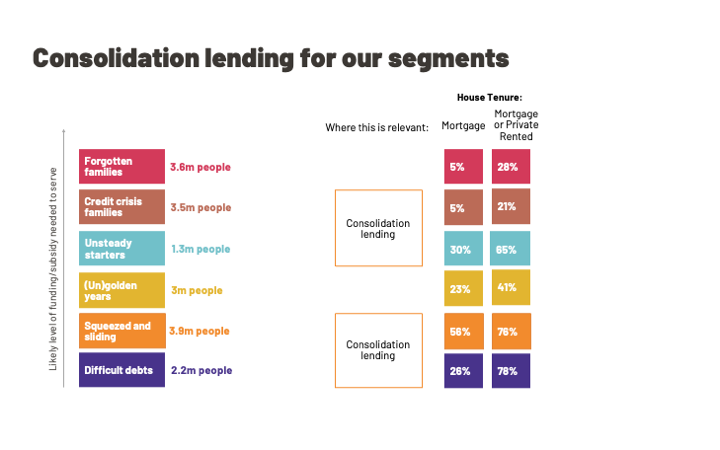

The current crisis is affecting everyone. Our segmentation research shows who consolidation lending can help, and market analysis shows a consolidation lending demand of up to £5bn.

For many prime customers (customers with typically good credit scores) these options are already available and the market is slick and efficient – it just works for them. That’s sadly not true for people in vulnerable circumstances, even though a consolidation loan could be a game changer, as the above example shows.

For people with mortgages – unsecured consolidation lending can also stabilise their finances and is a vital offer to customers identified as being at risk of going into arrears, so this has benefits to major lenders too.

Why doesn’t this happen already?

There are the usual reasons – the mythology about consolidation lending being ‘grubby’ and the hesitation by lenders to give customers the cash to settle their own debts.

New tech from two providers, Clearscore and Paylink, is changing the market – and enabling lenders to automate paying off customer debts directly – significantly reducing the uncertainty over how funds are used and ensuring a really clear affordability calculation.

At Fair4All Finance we’ve stood up funding and guarantees to help lenders offer this lending to those they currently don’t serve. We’ve been delighted with the Finance Conduct Authority’s (FCA’s) support of our work – to help get this lending done well through the innovation pathway support – clarifying what lenders can do when settling the debts directly, or not, especially on assumptions about affordability.

So, if you could just do one thing?

As I’ve mentioned, for many people debt repayments are a significant monthly expense, and for some consolidating and re-profiling these repayments over a longer term, or moving to a lower interest solution would make a huge difference. So ‘if you could just do one thing’ I’d ask you to consider consolidation lending as part of your product suite. It is a game changer.

If you’re interested in finding out more, we’d like to hear from you. Email us on consolidations@fair4allfinance.org.uk.