A Financial Inclusion Plan for the whole sector

With at least 17.5m people in the UK in financially vulnerable circumstances, it’s clear the goal of financial inclusion for all will only be achieved through a collaborative effort.

We’ve worked with mainstream finance, policy makers, regulators, community finance and third sector organisations to develop a shared Financial Inclusion plan to tackle financial exclusion head on.

We’re delighted that The Financial Literacy and Inclusion Steering Group, chaired by The Lord Mayor of the City of London, Nicholas Lyons, today called on the financial services sector to endorse and implement the priority areas of ‘Lack of Resilience’ and ‘Lack of Access’ in the Financial Inclusion Plan, which includes:

- Supporting the scaling of affordable credit and insurance

- Increasing the use of open banking and open finance techniques

- Delivering and scaling fair and affordable debt consolidation loan products

- Developing effective auto-enrolment savings products

Financial exclusion is a key barrier to opportunity

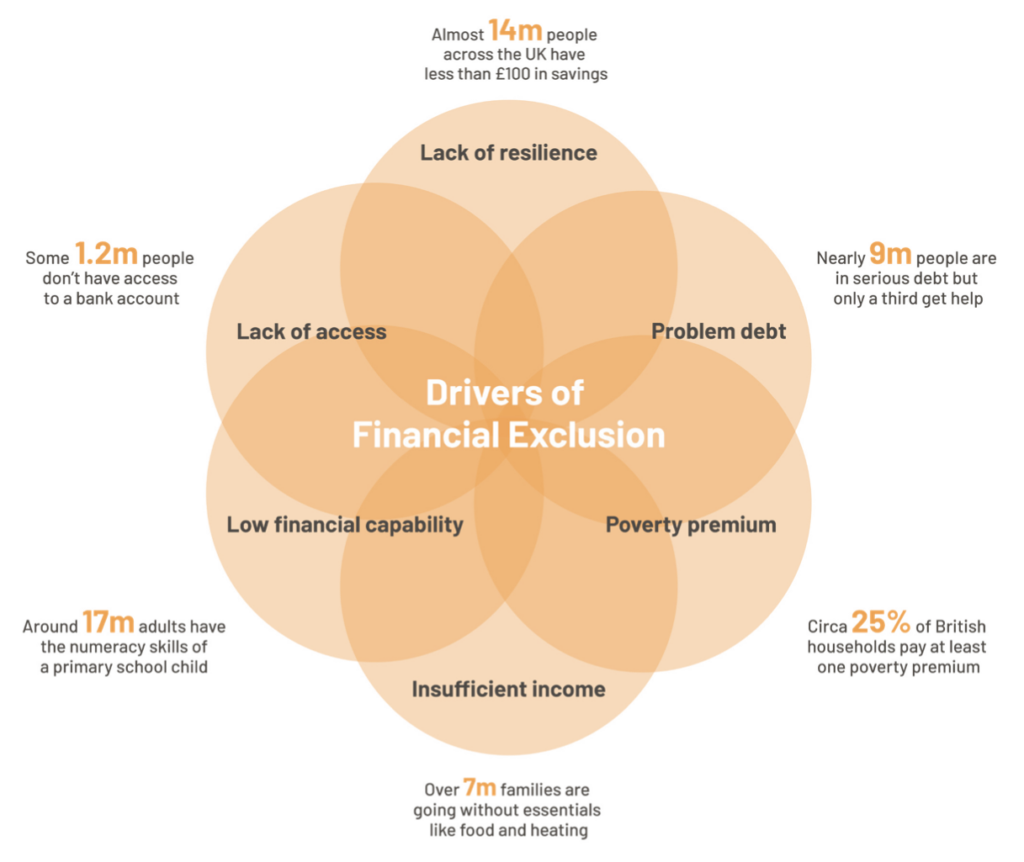

The Financial Inclusion Plan outlines activities to address the six key drivers of financial exclusion, who needs to lead on them and how coordinated action is the key to success.

It is very much a plan for the sector, owned by the sector, along with anyone with an interest or influence in creating a fairer financial services system.

We’ve also convened a Financial Inclusion Action Group with senior representatives from a wide range of commercial and not for profit providers, which owns the delivery of the Financial Inclusion Plan and how it develops.

We’d love for you to take some time to read and digest the plan and consider how you or your organisation can support the mission to create a fairer financial services system that provides everyone with the right products and services, whenever they need them.

We’re very happy to crowd source ideas to make the plan stronger, to get offers of support or other input that can help us improve financial inclusion. Email Jake Attfield at jake@fair4allfinance.org.uk to get involved.