Lived experience and how organisations can harness it to make a real difference

In the first of our Building Financial Inclusion Together blog series, we hear from Michael Hilton of Three Hands Insight on the power of lived experience and how organisations can harness it to make a difference

Looking out at the packed hall at the Fair4All Finance Financial Inclusion conference I wondered if the lived experts might have finally met their match.

Would they be comfortable in front of a room full of people rather than online, where so much of our work now takes place?

Would they be prepared to share their deeply personal experiences with 200 strangers?

Would they hold themselves back, self-censoring what they had to say?

Forty-five minutes later and I needn’t have worried – they were brilliant.

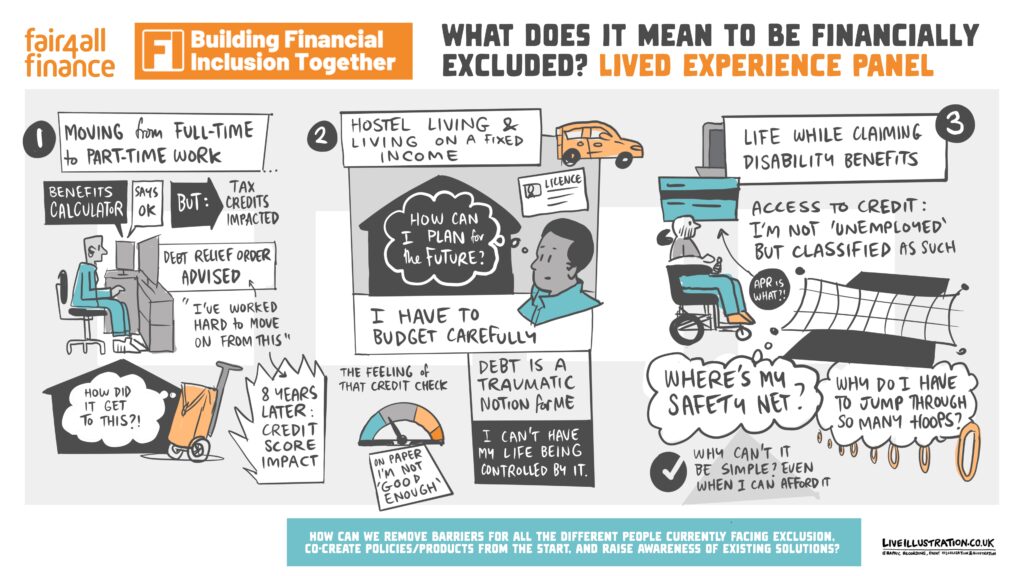

We heard how:

Following a debt relief order in 2016, Aneita turned her life around gaining a first-class degree and a good new job. However, when it came to securing credit she continued to be judged by what her history looked like on paper, not the reality of her life and achievements now.

James, who has a disability and receives a steady income from benefits, has given up trying to get home insurance as he was consistently declined when applying without any explanation given as to why.

Edward (not his real name), who had found himself in a homeless hostel a few years ago but now had a full-time job and rented his own home, was still stuck in financial limbo due to a combination of being caught in a housing benefit trap and being unable to improve his credit score.

And the three of them left us with a number of questions which hit at the heart of the injustice of financial exclusion.

- How did I get here?

- Why aren’t I good enough?

- What options are there for me?

The audience – a combination of people from financial services organisations, the public sector and civil society – was attentive, respectful and fired up.

And therein lies both the power and the challenge of lived experience* work.

*We define a lived expert as someone who has direct personal experience of certain circumstances (e.g. disability, mental health issues, neurodiversity) and/or certain life events (e.g. bereavement, debt, homelessness) and is able to share and apply these experiences to improve communication, products and services for all.

I lost count of the number of people who grabbed us afterwards to say that the panel was their highlight of the day; that what they heard would spur them on to action.

I have no doubt that they were being sincere in this but we have seen many times how the passion and fire that lived experience inspires in people can dissipate with time and the realities of trying to make change in the corporate world.

What can be done to ensure that lived experience leads to action? We all owe it to the lived experts who share their deeply personal experiences with us to find a good answer to this question.

The Social Model of Disability reframes how we think about disability – it is not the individual who is disabled but society which disables you. The same thinking should be applied to financial exclusion – the things that are shutting people out were created by us and we have the power to change them.

So here are six things that can make the difference, taken from the excellent discussions on lived experience at the conference and my own experience of working at Three Hands Insight.

1 Embracing Inclusive Design

Inclusive design is often talked about but rarely practised. Essentially, to steal CEO of Fair4All Finance Sacha Romanovich’s phrase, it means “bringing the voices of people who know what needs to be fixed to the heart of what we do”.

There are many ways to do this but we are particularly proud of the Inclusive Design Panel that we have developed with NatWest Group over the last two years. It’s a way to get feedback from a group of charity and lived experts representing a wide range of ‘vulnerable’ circumstances on everything from early-stage concepts to important pieces of communication.

Alongside the improvements suggested for the specific ‘products’, NatWest are also starting to see a wider cultural shift as more and more people have experienced the panel and the learnings are shared with 20,000+ product designers across the organisation.

2 Increasing representation

Despite some commendable efforts, most financial services organisations are not reflective of the wide range of customers in the UK whom they seek to serve.

Another great way to ensure a diversity of views at the earlier stages of developing a new idea is to bring those with lived experience into your organisations as employees, non-execs and trustees. If those with lived experience are part of the organisation, then their views can influence the development of new products and services from the start.

At the Money and Mental Health Policy Unit, more than 60% of the staff have their own experiences of mental health issues and this is just one way to make lived experience part of your business model

Fair4All Finance are also leading by example and are in the process of recruiting a ‘lived experience’ trustee for their board.

3 Combining stories with data

“Stories are just data with a soul”, researcher Brenee Brown once said, and she’s right that lived experience can bring attention to an issue that statistics will never do alone.

But equally, the stories are made stronger when we have the evidence to show that the individual experiences are common to those of many others.

Fair4All Finance’s new segmentation model is an excellent example of this, highlighting that over 20m people in the UK are currently in financially vulnerable circumstances and dividing them into six easily understandable groups.

Combining lived experience with quantitative data enriches both.

4 Activating others

Margaret Mead, an American anthropologist, is widely credited for saying that “a small group of thoughtful committed individuals can change the world. In fact, it’s the only thing that ever has.” However, in a big organisation that group must inspire a critical mass of people across the whole organisation (including the senior leadership) for change to truly take hold.

It’s critical to find ways to share the power of the lived expert’s experiences beyond those who were lucky enough to be in the room.

Videos and graphic illustration can both be powerful ways to do this – see the excellent illustration from the conference as a case in point.

As can ‘Outside In’ style sessions – essentially conversations with lived experts that are designed to reach a wider audience. But we must be extremely careful that these always have a clear purpose and do not slip into feeling like a human zoo!

5 Calling in the specialists

Businesses are rightly concerned about safeguarding and often worried about ‘doing lived experience wrong’.

The good news is there are a range of organisations – both charities and agencies – who have this expertise. We know how to reach people who have authentic experiences to share and how to involve them in a way that “leaves them in a better place than when you first engaged with them”, to use the words of Dr Ramya Sheni from ClearView Research.

In some cases that may even mean training community researchers to ask the questions and leaving the businesses and agency staff out of the room, particularly with some of the more marginalised communities that ClearView works with where there is a long legacy of mistrust.

6 The path is made by walking

And finally, the risk is that the challenge of making organisations and products truly inclusive feels so big that we get stuck before we even get going.

For this, I remind myself of a quote from Spanish poet Antonio Machado that is particularly popular with systems change practitioners: “Traveller, there is no path, the path is made by walking”.

In the Inclusive Design Panel this was put in more practical terms by one of the speakers: “Inclusive Design is easy if you treat it as incremental – pick a place to start and get going”.

Lived experience is extremely powerful but it must not be taken for granted. When real people share their deeply personal experiences they are doing so because they want to change things for the better for others who experience these things.

By learning from this, we can build more inclusive products and services that work better for everyone, not just those in ‘vulnerable’ circumstances.

And we can meet the demands of the Financial Conduct Authority’s Consumer Duty and other regulators in a progressive and inspiring way.