Access to credit and illegal lending: The shape of the market is as important as the size

Our new report looks in detail at the changing shape of the consumer credit market, and how with shrinking provision, demand is often being met by unregulated loans from friends and family and sometimes illegal lenders

The last decade has seen significant shifts in the UK credit market, with access to those on the lowest incomes becoming increasingly difficult. Balancing welcome consumer protection with access is difficult. For many lower income households it has become harder to borrow. However their need for occasional access to smooth expenditure and manage their finances remains.

This quantitative report aims to build on last year’s qualitative ‘As one door closes…’ report in which we highlighted the dangers of a growing credit vacuum for people on lower incomes and in financially vulnerable circumstances.

The findings from our two weighted GB online surveys undertaken in 2023 indicate that over 10m people say they had borrowed from friends or family in the previous 12 months, and more than 3m people had potentially used an unlicensed lender or loan shark in the last three years.

Newly released data in this report shows how 7% of respondents said they or someone in their household has used an illegal lender, and how 16% of those declined for regulated credit had either used a loan shark, or know someone in their household who had – compared to 5% of people who had successfully applied for mainstream credit.

It is difficult to escape the conclusion that the UK credit market is not functioning properly for people in lower income households. This Fair4All Finance report supports contentions about growing lack of access for many households highlighted in a number of other significant reports in the past 6 months. The significant challenge is reaching the right balance between consumer protection and consumer access to credit – the shape of the market is as important as the size.

Recommendations for change

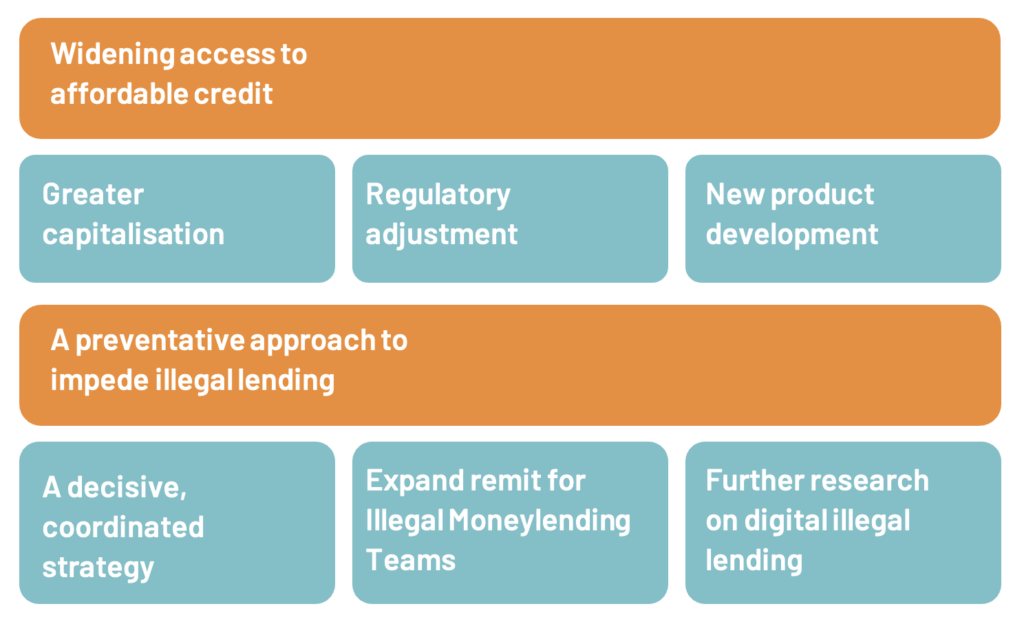

Action is needed to widen and deepen access to affordable credit. This will require a combination of new product development, regulatory adjustments, capital investment into community finance, a more prominent role played by mainstream banks including lending directly into the non-standard market as well as new forms of higher cost credit working within the better regulatory regime.

Critically, this requires a continued and renewed focus on developing a preventative approach towards illegal money lending by regulators and a range of other agencies

Widening access to affordable credit

1 Greater capitalisation

Driving initiatives that scale up and support the provision of community finance was called for in the Woolard Review in 2021. It was needed then and it remains needed now.

The scaling up of affordable credit will also require significant investment in technology, marketing and product development, as well as forms of loan capital or financial instruments.

2 Regulatory adjustments

Alongside a clear framework enabling small sum lending, a broader definition of what constitutes good consumer outcomes that includes access to credit, consumer protection as well as its affordability is required.

There are also continued misunderstandings on pricing and APR which require further considerations on appropriateness of APR as the measure in defining value.

3 New product development

There is further potential for mainstream providers to do more to enable the appropriate provision of credit to those on lower incomes, left behind communities and other groups.

Specifically, we believe the small dollar loans initiative operating in the USA is worthy of greater examination to assess what is replicable in the UK.

A preventative approach to illegal lending growth

4 A decisive, coordinated strategy

Given our concerns around the potential environment that is being created for illegal lending, it is in everyone’s interest to ensure a renewed national focus on this issue in light of current market conditions. Now is the window for the UK to develop and enact a decisive and coordinated preventative strategy on illegal lending led by the National Illegal Moneylending Teams across the nation and supported by HMT, particularly incorporating illegal digital providers and the associated financial and data harms.

5 Expand remit for Illegal Money Lending Teams

The National Illegal Money Lending Team’s remit should be expanded to specifically reference digital illegal lending, with an increase in resources required to develop the necessary skills and tools to tackle this.

Wider authorities with specific understanding of fraud and data crime also need to be aware and alert (where this is not already discreetly happening) to the potential danger from criminal operations using illegal online lending to intensify their cybercrime efforts.

6 Further research on digital harms

Our research shows the dangers associated with a growth of digital illegal lending, namely increased financial and data crime. Further research on this is required with Fair4All Finance and a range of partners to determine where there are the most significant concerns.